Is a Checking Account Better for Students Than Saving Account?

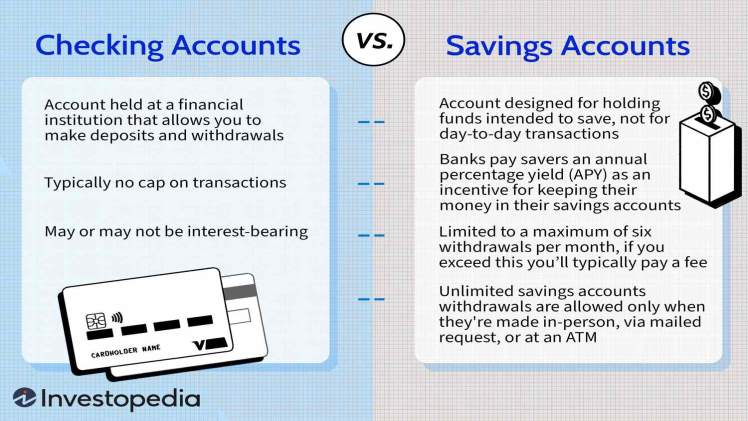

If you’re a student, chances are you’ve thought about which type of bank account is best for you: The most common question is the difference between checking and savings accounts. In this article, you will take a look at what each type of account can do for students and then help you choose the one that’s right for your needs so that you can easily make out the difference between a checking and savings account.

Savings Account Features

In addition to the two primary categories, savings accounts come in many flavors. Some have higher interest rates than others, while some require you to have a high minimum balance when you open them. Still, other savings accounts are only meant for saving money—they don’t allow you to use your deposited funds for spending purposes.

Savings accounts are FDIC insured up to $1 million (or more, depending on the institution), so they’re considered equally safe as checking accounts. But that’s not their only feature; savings accounts offer higher interest rates than checking accounts because they have fewer fees attached and don’t charge monthly maintenance fees as many checking accounts do.

Visit here for informative about Door Lock

Checking Account Features

Checking accounts is the best choice for students who plan on using their money in several ways. For example, many checking accounts offer free check writing, ATM withdrawals, direct deposit, and online bill pay options. Overdraft protection is another feature that can help you avoid paying hefty fees when you overdraft your account.

Fees and Monthly Maintenance Costs

If you’re paying a monthly maintenance fee, it’s usually worth keeping a minimum balance to avoid paying the fee. This is especially true if you have limited funds and can’t afford to keep enough money in your account to avoid a penalty.

With savings accounts, there are very few fees associated with them. However, the interest rate isn’t going to be as high as it would be with a checking account—at least not unless you can find an online savings account with no or low fees.

Is One Better Than the Other?

As with everything financial, it depends on your situation. For example, a checking account is likely better if you’re a student with an active social life and need to make frequent transactions—to buy textbooks, pay for books online or enter payments into your student account. You won’t have the hassle of writing checks or carrying cash around, and you’ll be able to keep track of how much money you have at all times with online banking. A savings account would only serve as an inconvenience in such instances.

However, suppose you prefer not to deal with these things (and who doesn’t?). In that case, a savings account can make sense because it’s designed for minimal activity and will be completely anonymous for those times when paying by check isn’t necessary or convenient (but still encouraged).

As per SoFi experts, “When it comes to earning a bit of a return on an online bank account, savings accounts typically offer a higher interest rate than checking accounts.”

In conclusion, you should choose the right account for you. For example, if you are a student or just starting out in life, choosing an affordable option provides all the necessary features for managing your money and staying on top of bills is important. Of course, checking accounts have many advantages over traditional savings accounts, but they also have pros and cons. The key thing is finding an account that works best for your needs!